Under new manager Ronald Koeman Southampton enjoyed another

season of decent progress in 2014/15 with the club achieving its highest ever

Premier League position, finishing 7th with a record 60 points, and qualifying

for Europe for the first time in 12 years.

This was a testament to the success of the Southampton

model, whereby a combination of thoughtful planning, good scouting and player

development has allowed the club to move forward, despite selling around £130

million of talent over the past two seasons.

Summer 2014 saw the departure of Luke Shaw, Adam Lallana,

Rickie Lambert, Calum Chambers and Dejan Lovren, while manager Mauricio

Pochettino also left for Spurs after 18 months at St Mary’s. The trend

continued this summer, albeit at a slower pace, with Morgan Schneiderlin moving

to Manchester United and Nathaniel Clyne to Liverpool.

Clyne is actually a good example of the Saints’ business

model, as his sale generated £12.5 million, while Southampton replaced him with

Cédric Soares, a 23-year old Portugal international, for £4.7 million, around a

third of the price.

"Long shot"

Up to now Southampton have managed to avoid the decline that

normally follows a club selling its best players and replacing them with

cheaper alternatives, though it has endured a fairly tough start to this

season, including a dispiriting early elimination from the Europa League at the

hands of Danish side Midtjylland. However, they now appear to be finding their

feet, registering an impressive victory against Chelsea and reaching the

quarter-finals of the Capital One Cup.

The club has also continued to thrive off the pitch with

solid financial growth reflected by a second successive year of profits and net

assets, though it will have to pay attention to its growing debts, including

substantial amounts owed on transfer fees.

Profit before tax fell £14 million from £29 million to £15

million in 2014/15, though the decrease was higher after tax, as the switch

from a tax credit of £5 million to a £3 million tax charge contributed to a

fall of £21 million from £33 million to £12 million.

The figures were “impacted by high exceptional costs” of £15

million, comprising £8 million of “onerous and cancelled contracts”, mainly the

termination of Dani Osvaldo’s deal, and £7 million of player impairment,

presumably including the 25% sell-on fee that Southampton had to pay

Bournemouth following Lallana’s sale to Liverpool. This should have been worth

£6.25 million, but it has been reported that Bournemouth accepted a reduced fee

of £4 million in order to facilitate the move.

Revenue rose 7% (£8 million) from £106 million to £114

million, largely due to more money from the Premier League TV deal for

finishing a place higher, though total commercial income grew by an impressive

18% (£2 million) to £11 million and match day was (7%) £1 million higher at £18

million. Profit from player sales was also up £12 million to a meaty £44

million.

Against that, wages were 15% (£9 million) higher at £72

million and player amortisation surged 43% to £30 million. There were also

increases of £4 million in other expenses, including a £1 million loss on

disposal of legacy training ground assets as part of the current development

project, and £1 million in depreciation and player impairment.

In addition, the previous year’s accounts benefited from £2

million compensation fees received that were classified as other operating

income.

Last season Southampton’s pre-tax profit of £29 million was

the third highest in the Premier League, only surpassed by Tottenham £80

million and Manchester United £41 million. Despite the fall to £15 million in

2014/15, Southampton have already overtaken United, whose absence from Europe

led to a £4 million loss, and their profits are better than Manchester City’s

£10 million, though Arsenal are now ahead of them with £25 million.

Of course, the days when the majority of clubs in the top

flight lost money seem to be over, as additional funds from ever-increasing

Premier League broadcasting deals, allied with the various Financial Fair Play

(FFP) regimes, have produced improvements in financial results almost across

the board. In fact, only five clubs lost money in the 2013/14 season.

The other driver of improved profitability is profits made

from player sales. In 2013/14 Tottenham led the way with an incredible £104

million, mainly from Gareth Bale’s transfer to Real Madrid, followed by Chelsea

£65 million (David Luiz to Paris Saint-Germain), then Southampton.

In 2014/15 all four clubs that have published accounts to

date have seen increases in profits from this activity: Southampton from £32

million to £44 million, Arsenal from £7 million to £29 million, Manchester

United from £7 million to £24 million and Manchester City from £200,000 to £14

million.

Southampton’s 2014/15 figures included money received for

the sales of Lallana, Lovren and Chambers, but Schneiderlin and Clyne will only

be reflected in the 2015/16 books, as they left after the 30 June accounting

close.

Producing a total of £44 million of profits before tax in

the last two years is a sign of what the club described as “financial and

structural stabilisation”. Indeed, the previous year’s profit was the first

time that Southampton had not declared a loss since they almost went bankrupt

in 2009. To provide some context, the Saints had accumulated £54 million of

losses in the six years between 2008 and 2013.

The club observed that the profit “is driven by sound

underlying business operations supplemented by player trading”, though that

tends to underplay the importance of player trading, which has boosted overall

profits by £76 million in the last two seasons.

Without these profitable sales, Southampton would have

reported losses of £32 million. Most of this, £29 million, was recorded in

2014/15 – though, in fairness, this season was also adversely affected by £15

million of exceptional items.

Given Southampton’s focus on player trading, it is worth

exploring how clubs account for transfers, as it has a major impact on reported

profits. The fundamental point is that when a club purchases a player the costs

are spread over a few years, but any profit made from selling players is

immediately booked to the accounts.

When a club buys a player, it does not show the full

transfer fee in the accounts in that year, but writes-down the cost (evenly)

over the length of the player’s contract. So, if Southampton spent £25 million

on a new player with a 5-year contract, the annual expense is only £5 million

(£25 million divided by 5 years) in player amortisation (on top of wages).

However, when that player is sold, the club straight away

reports the profit on player sales, which is essentially sales proceeds less

any remaining value in the accounts. In our example, if the player were to be

sold 3 years later for £32 million, the cash profit would be £7 million (£32

million less £25 million), but the accounting profit would be higher at £22

million, as the club would have already booked £15 million of amortisation (3

years at £5 million).

This is all horribly technical, but it does help explain how

Southampton’s model boosts their reported profits. Furthermore, any players

developed through a club’s academy have zero value in the accounts, so in these

cases any sales proceeds represent pure profit. Like other clubs, Southampton

are clearly keenly aware of this accounting treatment – though they also fully

appreciate that cash flow might be different (which we shall explore later).

Even though the annual cost of purchasing players is

therefore somewhat reduced in the profit and loss account, it is worth noting

that the impact of Southampton’s increasing gross spend in the transfer market

has pushed up player amortisation, which has gone up from £3 million in 2012 to

a hefty £30 million in 2015 (plus £7 million of player impairment).

Obviously this is nowhere near as much as big spenders like

Manchester United (£100 million), Chelsea (£72 million) and Manchester City

(£70 million), but it is still higher than all but the “Sky Six” in the Premier

League and will need to be kept under observation in future years.

The other side of the coin here is that all these player

purchases have helped strengthen the balance sheet with player values (reported

as intangible assets) climbing to £75 million, compared to only £4 million just

four years ago. This has helped increase the club’s net assets (assets less

liabilities) in the last 12 months from £32 million to £44 million.

Even though player trading (and particularly profits from

player sales) have such an important impact on Southampton’s bottom line, we

should acknowledge that the club has also become profitable from its core

business. This can be seen by looking at the EBITDA (Earnings Before Interest,

Taxation, Depreciation and Amortisation), which can be considered a proxy for

the club’s profits excluding player trading. After many years of negative

EBITDA, this has turned positive in the last three years, though it did fall

back from £28 million to £21 million in 2014/15.

This is not bad, but at the same time helps to explain why

Southampton have been so reliant on a player sales business model, as the EBITDA at those clubs that Sam Allardyce refers to as the “big boys” is significantly higher, despite larger wage bills: Manchester United

£120 million, Manchester City £83 million, Arsenal £64 million, Liverpool £53

million and Chelsea £51 million.

In fairness, Southampton have managed to grow their revenue

by around 670% in just five years from £15 million in 2010 to £114 million in 2015,

facilitated by two promotions in that period. In particular, £83 million of the

£99 million growth since 2010 is due to significantly better TV deals in the

Premier League. That said, commercial income has increased by 187% (£7

million), while match day is up 82% (£8 million).

Southampton’s 2015 revenue of £114 million places them very

much in mid-table in the Premier League (they were 11th highest the previous

season) around the same level as Aston Villa and West Ham. Although

Southampton’s 2014/15 revenue growth of 7% was not as high as the previous

season, this is very largely linked to the cycle of the TV deal. As last season

was only the second year of the

current three-year TV deal, it is unlikely that other clubs will see

significant revenue gains in 2014/15.

Of course, the Saints are still miles below the English

elite, e.g. the top four clubs all earn more than £300 million: Manchester

United £395 million, Manchester City £352 million, Arsenal £329 million and

Chelsea £320 million.

Such an enormous revenue disparity underlines the magnitude

of Southampton’s challenge in trying to move to the next level. As Koeman put

it, “You never know, but it’s not realistic at the moment to finish in the top

four. The Europa League for us is like the Champions League for Manchester

United and Arsenal.”

However, Southampton’s revenue is now the 25th highest in

the world according to the Deloitte Money League, around the same as famous

clubs such as Marseille £109 million, AS Roma £107 million and Benfica £105

million. Impressive stuff, but that doesn't help much in the Saints' domestic battle.

This is largely on the back of broadcasting revenue of £84

million, which now accounts for 74% of Southampton’s total revenue. Match day

revenue contributes 16% with commercial income only 10%. Chief executive Gareth

Rogers is acutely aware of the need to grow the other revenue streams: “Whilst

we may have very, very, very large broadcasting income within the Premier

League, every club has it. Therefore, you have to do something else in order to

differentiate yourself and the commercial income is important as a result of

that.”

As you might imagine, Southampton’s reliance on TV money of 74-75% is

one of the highest in the Premier League, but the previous season no fewer than

six clubs had a greater dependency with Crystal Palace leading the way at 82%.

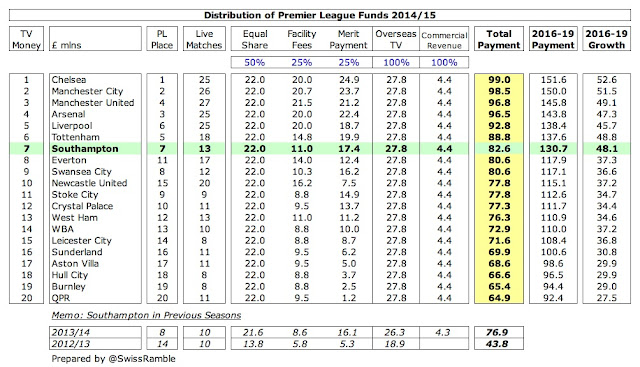

Considering the significance of Premier League television

money to the Saints, it is worth exploring how this is distributed in some

detail. In 2014/15 Southampton’s share rose 7% from £77 million to £83million.

This is based on a fairly equitable distribution methodology with the top club

(Chelsea) receiving £99 million, while the bottom club (QPR) got £65 million.

Most of the money is allocated equally to each club, which

means 50% of the domestic rights (£22.0 million in 2014/15), 100% of the

overseas rights (£27.8 million) and 100% of the commercial revenue (£4.4

million). However, merit payments (25% of domestic rights) are worth £1.2

million per place in the league table and facility fees (25% of domestic

rights) depend on how many times each club is broadcast live.

In this way, Southampton were helped by climbing one place

to 7th and being broadcast live on three more occasions. However, they were

still only shown live 13 times, as compared to Liverpool’s 25 times (even

though only one place separated them in the league table), which meant that

they earned £9 million less than the club from Anfield.

My estimates suggest that Southampton’s 7th place would be

worth an additional £48 million under the new contract, increasing the total

received to an incredible £131 million. This is based on the contracted 70%

increase in the domestic deal and an assumed 30% increase in the overseas deals

(though this might be a bit conservative, given some of the deals announced to

date).

Another way that Southampton could generate more money is

with a successful European run, though they were eliminated before the Europa

League group stages in 2015/16. Admittedly, that competition does not bring in

substantial funds unless you actually win the competition, but it did earn

Everton €7.5 million last season.

The big money is obviously in the Champions League with

English clubs averaging €39 million in 2014/15, especially as the new TV deal

from the 2015/16 season is worth an additional 40-50% thanks to BT Sports

paying more than Sky/ITV for live games.

This might feel like an unrealistic aspiration for

Southampton, but it is clearly in the long-term plans of the club’s hierarchy,

as chairman Ralph Krueger outlined: “People tell us it’s not possible, with our

budget and our infrastructure. We believe it is.” Executive director Les Reed

was equally bullish, “We’d like to think we have the structure to (reach the

Champions League) in the next five years.”

Match day revenue rose by £1.2 million (7%) from £17.1

million to £18.3 million, despite playing one less home game, thanks to an

increase in average attendance from 30,212 to 30,652 and a 4% rise in ticket

prices.

Despite this

increase, Southampton’s revenue is still miles below Manchester United and

Arsenal, who both generate around £100 million from this activity, though it is

around the same as Everton £19.3 million and West Ham £19.5 million and

actually above Sunderland £15.8 million and Aston Villa £12.8 million.

Southampton’s match day revenue is outperforming their

attendance, which is only the 13th highest in the Premier League, because their

ticket prices are on the high side. The good news for Saints season ticket

holders is that renewal prices were frozen for 2015/16, leading to a 20,000

sell-out.

However, Southampton’s renaissance can be seen through their

improving attendances over the last few years with their 30,500 average since

their return to the Premier League being 70% higher than the 17,800 low point

in 2008/09.

Commercial income grew by £1.7 million (18%) from £9.5

million to £10.3 million, which means that this revenue stream has more than

doubled since promotion to the Premier League. However, although this “remains

a key focus on the board”, this is still far away from the massive sums

generated by the elite clubs, e.g. Manchester United £196 million and

Manchester City £173 million. Fair enough, but the Saints are also below clubs

like Norwich City and Stoke City.

Chief executive Rogers has acknowledged the need to

significantly improve the club’s commercial operations, but admits that the

club is only “at the start of that journey”, emphasising that fans will not see

an overnight improvement.

He explained, “It can be a slow process, there's no two ways

about it. When you look at commercial contracts, a) the first one has to finish

and b) you're not going to get companies to commit to multi-million pound deals

on the whim of one conversation. These conversations can take a long time to

evolve and a long time to develop and, therefore, we do expect it to be the

future years where you really do start to see this commercial growth.”

That’s undoubtedly true, though he did say almost exactly

the same thing the previous year and, despite Brand Finance recognizing

Southampton as one of the fastest growing football brands, there is plenty of

room for improvement.

That’s certainly evident when you look at Southampton’s main

commercial deals, e.g. the shirt sponsorship with consumer electronics firm

Veho is one of the lowest in the Premier League at £1 million a season .Given

the club’s booming brand, they should certainly aspire to securing a £3-5

million deal when the current agreement expires at the end of the 2015/16

season.

Southampton terminated its long-term kit contract with

Adidas in December 2013 (after it released a controversial home shirt without

the traditional stripes), but surprisingly there was no replacement in place,

which meant that the 2014/15 kits were made in-house. Adidas has returned as

kit supplier for the 2015/16 campaign, which should have a beneficial impact on

this season’s financials.

Excluding the £8.3 million cost of onerous and cancelled

contracts, the wage bill rose 15% (£9 million) from £63 million to £72 million,

increasing the wages to turnover ratio from 59% to 63%. As Rogers said, “We

believe we have a much stronger squad, but naturally the cost for that

reinvestment is there, and that’s shown within the wages that have grown this

year.” The number of employees increased from 283 to 302, meaning that the

staff numbers have shot up by 72 (31%) in just two years.

This is likely to be one of the higher wages to turnover

ratios in the Premier League last season, but is nothing like as bad as the

125% Southampton reported in 2012 (though this was inflated by £5.3 million of

promotion bonus payments). Also, to be fair, 13 of the 20 clubs were in a

fairly narrow range of 56-64% the previous season.

It was striking how much Southampton over-performed in

2013/14 relative to their wage bill, which was only the 15th highest in the

Premier League, while they finished 8th. Only five clubs had lower wages (Stoke

City, Cardiff City, Norwich City, Crystal Palace and Hull City) and two of

those were relegated.

However, the 2014/15 growth will almost certainly place the

Saints higher in the wages league, though they are obviously a long way behind

the leading clubs: Manchester United £203 million, Manchester City £194

million, Chelsea £193 million and Arsenal £192 million. Little wonder that Les

Reed commented, “We will always be vulnerable to our very best players being

attractive to the top clubs, who can afford to pay salaries that we just can’t

get near.”

Nevertheless there is a clear bunching of clubs in the

£60-70 million range, as the traditional bigger spenders like West Ham and

Aston Villa have only grown a little, while the nouveaux

riches like WBA, Stoke City, Swansea City and indeed Southampton

have all had to significantly increase their wage bill in order to compete. As

Saints striker Graziano Pellè noted, “All the teams are now building really

good squads. The difference is minimal.”

It is certainly true that Southampton have spent big in the

transfer market since returning to the top flight in 2012/13, averaging annual

gross spend of £43 million in those four years, compared to just £2 million in

the previous six years.

In the last two years, they have really ramped up, splashing

out £103 million on a lengthy shopping list of players: Shane Long £12 million,

Virgil van Dijk £11.5 million, Dusan Tadic £10.9 million, Fraser Forster £10

million, Saido Mané £10 million, Ryan Bertrand £10 million, Pellè £9 million,

Jordy Clasie £8 million, Florin Gardos £6 million, Juanmi £5 million, Oriol

Romeu £5 million and Soares £4.7 million.

That said, they have also made a lot of money from player

sales, leading to net sales of £26 million in this period. In fact, Southampton

are the only club in the Premier League without a positive outlay on players

over the last two seasons, so are bottom of the so-called net spend table.

To once again highlight Southampton’s nifty footwork in the

transfer market, many clubs spent big, most notably Manchester City £151

million, Manchester United £145 million and Arsenal £74 million. However, this

is no guarantee of success, as can be seen by the club with the fourth highest

net spend, namely Newcastle United, whose £62 million has clearly not been

spent wisely.

The difference with Southampton is that it feels like they

have a long-term plan where any sales are made on their terms and at their

price. Rogers confirmed this: “We make decisions based on what is the best

thing for the club at the time. We don’t need transfer fees to fund the

operating costs of the club.”

Krueger added that the club was not worried about the

numerous ins and outs: “The world around us had a problem with it, but we

didn’t, because what happened last summer and this summer gave us the

opportunity to deepen the squad.”

Southampton’s net debt increased by £23 million from £25

million to £48 million, as the £11 million rise in gross debt from £51 million

to £62 million was exacerbated by the £12 million reduction in cash balances

from £26 million to £14 million.

The gross debt of £62 million includes £32.7 million owed to

the owner Katharina Liebherr (up from £14.7 million the previous year), a Swiss

loan facility of £15 million secured on the owner’s personal estate plus a

£13.9 million loan with Macquarie Bank (replacing a Vibrac loan on better

terms).

This is a fairly high debt for a club of Southampton’s size,

which Rogers acknowledged: “Fundamentally as a business we don’t want to be

carrying that level of debt, even if the majority of it is to the owner, though

it’s not actually increased as much as we thought it would do, due to good

governance and various other things.”

"Is Vic there?"

However, the hope is that the debt has now peaked, with

Rogers adding: “It’s a figure that we aim to reduce over time, but in a managed

way, so it doesn’t affect the on-field success of the business.”

What is striking is how much the club has made use of

transfer fee funding, i.e. stage payments, as can be seen by the increase in

transfer fees payable from £26 million to £43 million, though Southampton are

in turn owed £55 million by other clubs. This latter point is important in

terms of how much cash is really available for investment. Specifically, it

looks like Southampton have driven a hard bargain in terms of a player’s

selling price, but have been more flexible on when the money is actually paid

to them.

In addition, Southampton’s contingent liabilities, dependent

on the number of first team appearances, goals and international debuts being

made, have increased from £1.7 million to £5.1 million.

In fairness to the Saints, their debt is still one of the

smallest in the Premier League with five clubs having borrowings above £100

million, namely Manchester United £411 million, Arsenal £234 million, Newcastle

United £129 million, Liverpool £127 million and Aston Villa £104 million.

Although Southampton have reported largish accounting profits

in the last two years, this does not necessarily mean that the club has

produced cash, as can be seen by reviewing the cash flow statement for 2014/15.

On the plus side, the club generated £17 million from

operating activities, but then spent a net £31 million on player purchases

(remember those stage payments on transfers); £6 million on improving

infrastructure, such as the Markus Liebherr Pavilion that has resulted in an

additional 9 pitches and an all-weather state of the art dome; and a further £2

million on loan interest.

That left a £22 million deficit, which was partly financed

by £18 million of additional loans from the owner, though £8 million was used

to reduce other loans. All of this led to a net £12 million reduction in cash.

This point is better illustrated by Southampton’s cash flow over the last three seasons, when they have had a £120 million available to invest. Half of this has come from operating activities, but the other half has been provided by additional loans. Almost 60% (£71 million) of this has then been spent on players with a further £32 million invested into the Training Campus and other infrastructure projects. Just over £4 million has gone on interest payments, while the cash balance has increased by £12 million in this period.

This essentially backs up the chief executive’s assertions

that “We have categorically reinvested everything we have received in sales of

players in the past two years.”

It also highlights the fact that the owner’s support will

still be valuable for a little longer. The Swiss-German Katharina Liebherr has

certainly delivered the “stability and calm” that she promised the fans after

inheriting the club after her father’s sudden death in August 2010, notably

taking the departure of former chairman Nicola Cortese in her stride in January

2014.

Liebherr has put in more than £70 million to date, including

writing-off the £38 million of loans made up to June 2012 by converting these

into equity capital, leaving the amount owed to her at £32.7 million as at June

2015.

Importantly, she has not taken advantage of the club’s

new-found prosperity to reduce her debt, as Rogers confirmed: “There was an

opportunity to clear the entire debt of the football club and take out money

that had been put in, but Katharina didn’t do that. Instead she allowed us to

re-invest all of the money, either in fees or contracts.”

So much so that Southampton’s cash balance actually fell to

£14 million, while the trend at other clubs has seen cash increasing, e.g.

Arsenal from £208 million to £228 million, Manchester United £66 million to

£156 million and Manchester City from £21 million to £75 million.

As well as player trading, developing young players is one

of the principal reasons for Southampton’s success with significant investment

being made into this area, as noted in the accounts: “For the advancement of

the player development business model, total expenditure on the Training Campus

is expected to amount to approximately £38 million.”

Not only will this enable the club to replace any sold

first-team players from within, but also to sell its graduates for a healthy

profit. A recent study by the CIES Football Observatory showed that Southampton

had the most profitable academy in Europe, based on the sale of graduates like Lallana

and Shaw since 2012.

"Reel around the Fonte"

Incredibly, this put the Saints above the likes of Real

Madrid, Barcelona, Bayern Munich and Manchester United. As CIESC noted,

“Southampton is an outstanding example of how youth training can constitute a

key competitive advantage both sportingly and economically even in the richest

league of the world.”

There are few signs of this slowing down with eight academy

graduates featuring in the first team last season and the Development Squad

winning the U21 Premier League Cup. The club has high hopes for Matt Targett,

Harrison Reed and England U16 captain Callum Slattery.

Les Reed outlined the club’s aim to incorporate players into

a successful first team squad: “That’s got to be six (coming through). There’s

no point running an academy at category one level if you think you’re only

going to get one through every now and again. We have raised a banner and shown

you can produce homegrown talent.”

"Pelle the Conqueror"

Southampton’s recovery from the dark days of administration

has been highly impressive, as they have intelligently applied their business

model, while still listening to the input from their “real football men”. As

they say, “the foundations are in place for the club to build upon its sporting

success and to move forward sustainable.”

Then again, they remain “wary of the balance to be struck

between ongoing sustainability and investment” to achieve that success, which

some supporters have taken as an indication that the club is unwilling to spend

big to meet its objectives. However, Krueger quickly dismissed these concerns:

“In the end we will never forget that the final product on the pitch, out there

with Ronald and the team, is our main priority.”

"Something that I Sadio"

The chairman did concede that players might still leave,

e.g. the exciting winger Sadio Mané seems to be lined up for a big money move

to Manchester United, but he believes that Southampton will not be a selling

club forever: “The goal is, of course, over time that this is a final

destination. Maybe it isn't yet for players, but we're moving towards that.”

There are obviously no guarantees that the Southampton model

will continue to work, as it is very difficult for clubs to continually

reinvent themselves after major upheaval, but they have demonstrated that they

are better than most at trading players. As Les Reed said, “As long as we’ve

got the ability to keep replacing them, we can still achieve our ambitions.”

And that’s pretty much the bottom line for the Saints.

User friendly and most informative. As a Southampton supporter who has often 'vented his spleen' about the club's transfer policy etc,I know I have been selective over the figures I have used in my arguments. Your Article lays out the detail in a way which even I can understand and may prevent me from uninformed outbursts in the future.Possibly....... Most helpful, Thanks

ReplyDeleteSuperb

ReplyDeleteBrilliant article! Soo informative. Thank you very much for writing this. You should do 2016 as well :)

ReplyDelete